Should Tanzania establish a sovereign wealth fund?

3. Some experiences with petroleum funds

4. A simple political economy model of petroleum funds

4.1 The equilibrium in the future

4.2 Current policy decisions and the future equilibrium

How to cite this publication:

Ragnar Torvik (2016). Should Tanzania establish a sovereign wealth fund? Bergen and Dar es Salaam: Chr. Michelsen Institute & REPOA (CMI Working Paper WP 2016:5)

Abstract

Many natural resource abundant countries have established sovereign wealth funds as part of their strategy of managing the resource wealth. The paper looks into different arguments used as reasons to establish such funds, discuss how these funds are organized, and draw some policy lessons. The paper then develops a theory of how petroleum funds may affect the economic and political equilibrium of an economy, and how this depends on initial institutions. A challenge with petroleum funds is that they may produce economic and political incentives that undermines their potential benefits. In conclusion, the paper suggests that the best way to manage the petroleum wealth of Tanzania may not be to establish a sovereign wealth fund, but rather use revenues to invest domestically in sectors such as infrastructure, education and health. Such investments may produce a better economic, as well as institutional, development.

This paper is a product of the research programme ”Tanzania as a future petro-state: prospects and challenges”, funded by the Royal Norwegian Embassy in Dar es Salaam. An earlier version of the paper was presented at REPOA’s 21st Annual Research Workshop, Dar es Salaam, April 6-7, 2016. I am grateful for many comments from the workshop participants, and for comments on a revised version from Odd-Helge Fjeldstad and Jan Isaksen.

Keywords

Fiscal policy

Extractive industries

Resource curse

Sovereign wealth fund

JEL Classification

E21, E62, Q32, Q38

1. Introduction

Countries rich in non-renewable resources, such as petroleum, face many challenges – as well as opportunities – in their institutional design. On average, these countries have experienced lower economic growth, less democracy, more social unrest, and an erosion of their institutional quality (Gelb, 1988; Sachs and Warner, 1995; Lynn, 1997; Collier and Hoeffler, 1998; Ross, 2001a,b; Mehlum, Moene and Torvik, 2006; and van der Ploeg, 2011). Such outcomes have sparked an interest in policy solutions to deal with these possibly unfavorable effects of resource abundance. A main challenge with the literature on the so-called resource curse, however, is that it is mainly positive; describing the economic and political outcomes resulting from resource abundance, but being short in offering policy advice. A major next step in the development of this literature should therefore be to develop its normative implications: how should policies and institutions be designed so that resource abundance produces favorable, rather than unfavorable, economic and political outcomes?

Exploration for oil and gas in Tanzania started in the 1950s. The first discoveries were made in the 1970s, and commercial production started in 2004. Since 2010, additional huge reserves have been discovered offshore the southern coast. The size of the total confirmed gas reserves is currently standing at more than 57 trillion cubic feet (Cappelen et al. 2016). There are prospects for additional offshore, as well as onshore, reserves of both gas and oil. In this perspective, one key question is whether Tanzania, should follow in the footsteps of many other countries and establish a sovereign wealth fund to manage the revenues from non-renewable resources.

Tanzania already has a considerable production of natural gas, but if new off-shore investments in extraction and new onshore investments in a liquefied natural gas (LNG) plant are decided, these revenues may increase substantially. A main uncertainty, in addition to these investment decisions, is the future development of petroleum prices. New technologies, in particular related to shale gas and oil in North America, are increasing the supply of petroleum and may establish a ceiling for future average petroleum prices. This paper does not study this uncertainty, but takes as a premise that the probability of high future incomes from natural gas in Tanzania is sufficiently high that it is worth thinking through the consequences for the institutional design. And in particular: Should Tanzania establish a sovereign wealth fund?

It is important to distinguish between two different purposes of petroleum funds. Savings funds, on the one hand, are sovereign wealth funds with the aim of transferring petroleum wealth into long-term financial wealth. They are a vehicle for long-term management of petroleum revenues. Stabilization funds, on the other hand, are funds that aim to preventing short-term fluctuations in revenues to turn into short-term fluctuations in government spending. This can be done, for instance as in the copper fund in Chile, by spending less than the total revenues when the prices are high, and more when prices are low. This paper is mainly concerned with savings funds, although it is important to acknowledge that also saving funds have short term stabilizing properties on the economy.

The first petroleum fund established was the Kuwait Investment Authority in 1953. Later petroleum funds include the Alberta Heritage Savings Trust Fund in Canada, established in 1976, the Alaska Permanent Fund established the same year, and the Norwegian Government Pension Fund Global established in 1990. In recent years, petroleum funds have spread to many petroleum producers, including an increasing number of African states. Countries such as, for example, Angola, Chad and Nigeria, have established sovereign wealth funds to manage their petroleum revenues. A main reason for the increasing number of such sovereign wealth funds is probably the experiences with some of the existing funds, which have been seen as a favourable way both to manage the petroleum wealth, and to channel petroleum incomes into public budgets. Such funds can contribute to the long term income potential from oil and gas resources being reached, but can also have the opposite effect. A key determinant is the initial institutions in place. Unfortunately, much policy advice seem to neglect this. A main difference is whether institutions are inclusive or extractive (Acemoglu and Robinson, 2012). And moreover, as will be argued below, institutions may be endogenous to the decision to establish a petroleum fund itself.

The rest of the paper is organised as follows. In Section 2 arguments for why a petroleum fund can produce favourable economic and political outcomes are discussed. Section 3 presents some policy decisions that should be made if a government chooses to establish a petroleum fund. Some experiences with existing petroleum funds in North America and in Norway, and with petroleum funds established in African countries, are also addressed. Section 4 develops a model to discuss policy options with resource income, with the emphasis on the trade-off between investing in financial wealth through a petroleum fund, and investing in infrastructure or human capital. At the centre of the analysis are the possible consequences of the allocation of entrepreneurs between productive activities and unproductive rent-seeing, and how decisions in the future depend on policy design in the present. This framework is then extended to discuss how the future equilibrium institutional quality depends on the decision to establish a petroleum fund in the present, and also how the private investments today may depend on the decision to establish such a fund. Section 5 offers some concluding remarks.

2. Why petroleum funds?

There are several reasons a petroleum fund may help alleviate challenges that follows from the abundance of oil and gas. A petroleum fund makes policy more rules based, and less the object of day to day political decisions. This has the potential effect of ensuring a better long term perspective on the policy of petroleum assets. Such a long term policy view is important for several reasons. First, what is often termed petroleum income is not really income in the conventional sense, but selling off one type of assets (non-renewable natural resource assets) and replacing them with another (dollars). The establishment of a petroleum fund is a way to manage this transition from resource wealth to financial wealth. Continuously using the petroleum proceeds for consumption is not equivalent to using regular income. Rather it is the equivalent of running down the total assets of a country, thus reducing total wealth. Second, consuming too much of the petroleum proceeds in the short run induces a structural shift away from traded and towards (public and private) non-traded sectors that is not sustainable. It has, at some point, to be reversed. The traded industries lost today have to be gained again in the future. Given that back and forth is not the same distance, such reversals are costly, and likely to induce considerable unemployment. Third, a petroleum fund may contribute to investment decisions being based on long term economic criteria, and not day to day political decisions. Investment decisions based on political criteria that involves clientelism, patronage, corruption and nepotism have been identified as a main challenge in petroleum abundant countries (Robinson, Torvik and Verdier, 2006). Fourth, a petroleum fund ensures the decoupling of resource spending and resource income. Petroleum prices and production levels are volatile, and a petroleum fund can transform such volatile income streams into more stable government spending. This has a stabilisation effect on the economy, ensuring that the cycles in the resource sector are not magnified by pro-cyclical use of resource income. It also allows for a more stable provision of public services. In conclusion, there are many attractive properties of establishing a petroleum fund.

3. Some experiences with petroleum funds

Several petroleum funds, such as the Alaska Permanent Fund and the Government Pension Fund Global in Norway, are widely seen as contributing positively to good management of natural resource wealth. Many countries have drawn inspiration from these institutional designs of petroleum funds. In particular, when establishing a petroleum fund three questions need to be addressed. First, how much of the petroleum revenues shall be channelled into the fund? Second, how shall the fund be managed? Third, how shall payments out of the fund be decided? The various petroleum funds that have been established provide different solutions to these questions. And the experiences with these solutions have produced some important policy lessons.

A main lesson from the funds in countries with strong institutions comes in particular from comparing the funds in Alaska and Norway with that of Alberta in Canada: when the investment decisions and the management of the funds are made independent of politicians and political decisions, their performance have been better. The initial experiences from the fund in Alberta shows how political decisions and political management eroded the values in the fund, led to overspending as compared to the intention, led to a smaller fraction of the petroleum revenues than intended being transferred into the fund, and led to investment decisions that did not meet economic criteria. The experiences from Alaska and Norway have been better due to the arm’s length distance between political decisions and the management of the fund. For a detailed summary of these experiences, see Torvik (2011).

There are also important lessons that can be drawn from the petroleum funds on the African continent. A challenge with setting up these funds has been that the initial institutions in place have generally been weaker than in North America or Norway. On the one hand, one could argue that this makes the establishment of a petroleum fund more important, as the quality of political decisions on how to spend resource revenues may be worse. Thus, the potential payoffs from establishing a new institution such as a petroleum fund might be more important. On the other hand, one could argue that a weak initial institutional and democratic infrastructure makes the establishment of such a fund more risky, since the probability that the fund is not managed and used as intended increases. One could also argue that the need for public investments is typically higher in African countries than in mature industrialised countries, meaning that the optimal trade-off between current and future spending is shifted towards the present. Then, a petroleum fund, which has as one of its main motivations to save resource income for the future, is less relevant.

Some of the initial experiences with petroleum funds in Africa are not favourable. One particular example is Chad. The country, assisted by the World Bank, established a “future generations fund” where petroleum revenues were set aside. The fund was set up as part of an agreement with the World Bank, which involved financing of the pipeline from Chad to the port in neighbouring Cameroon. However, when political tensions erupted in Chad the fund was raided by the president and spent on the military. As a response, the World Bank aborted their relations with the regime. Another example is Angola, which established a petroleum fund in 2008. In 2013 the son of President Dos Santos was appointed head of its board of directors. This questions whether the petroleum fund in reality is setting up a new way to manage the resource wealth, as well as its independence from the current political elite holding power.

In the next section I discuss some political economy arguments relevant for the decision to establish a fund, and also how the design of a petroleum fund, given that it is established, should depend on the initial institutional equilibrium. To shed some light on such questions, I develop a simple framework of the political economy of petroleum funds.

4. A simple political economy model of petroleum funds

Consider a country with incomes from natural resources, and let us start out with a situation where a fund is established based on the institutional designs in Alaska or Norway. To see how this may play out, we use backwards induction and start with the implications for the future, before moving back to the implications in the present.

In the Alaskan and Norwegian type of petroleum funds, all of the investments are in financial assets. This implies that the sale of non-renewable natural resources today means more financial assets tomorrow, of which some fraction is used through the public budgets. In Alaska half of the payments out of the fund is given as direct lump-sum transfers to each citizen, while in Norway all of the payments enter into the regular public budget. This implies that, when tomorrow comes, there will be a fund which contains financial assets. These financial assets may invite rent-seeking, corruption or grabbing if institutions are not sufficiently strong to prevent it. Assume that they are not. In this case, in the future the relative payoff of entrepreneurs will have shifted towards rent-seeking and away from production.

To consider the possible future implications of this, I build on and extend the frameworks developed in Torvik (2011) and Robinson and Torvik (2013). Assume that entrepreneurs allocate their time or activities between production and rent-seeking, where the latter may have multiple interpretations such as lobbying, rent-seeking, politics with the motivation of embezzling funds, grabbing etc. Let the payoff for an entrepreneur choosing productive activities be increasing with the number of other entrepreneurs that choose the same activity. There are several reasons for this to be the case. More entrepreneurs in production means fewer entrepreneurs in rent-seeking. Thus, there are fewer predators on more prey, which from the point of view of productive entrepreneurs increases their individual payoff. There may also be increasing returns to scale at the aggregate level in the sense that the more entrepreneurs undertaking production, the higher is the payoff to each of them. Higher aggregate production means an increased size of the market, which in turn will imply higher sales and profits for each entrepreneur. Higher production means higher employment, less crime, and again higher profits for each entrepreneur. In Figure 1, the share of entrepreneurs in production, denoted by E, is measured from the left to the right. The individual payoff is increasing when a larger share of entrepreneurs are allocated into production, and consequently a smaller share is allocated into rent-seeking.

The income from production also depends on the quality of the public sector. In particular, if the quality of infrastructure is higher, this represents an advantage for entrepreneurs in private firms, pushing their profits, and thus the payoff curve in Figure 1, up. Also, if the education and skill level of the population is higher, then this has the same effect. Finally, the payoff of entrepreneurs depends on the quality of institutions. Strong institutions, which protect private property rights from public and private predation, and ensures that the government employees act in accordance with the interests of society rather than their own narrow personal interest, makes the income from undertaking production higher.

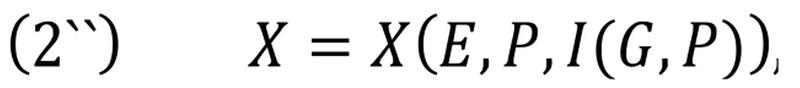

This insight may be summarised in that the future income possibilities from production, which we term Y, is given by a function of (i) the future share of entrepreneurs in production, which is termed E, (ii) the quality of public infrastructure and the investments that have been made in health and education which we term G, and (iii) the quality of institutions, which we term I:

with

We next move on to discuss the future payoff from undertaking rent-seeking. The larger the share of entrepreneurs undertaking production, and consequently the smaller the share of entrepreneurs undertaking rent-seeking, the higher is the payoff to each individual rent-seeker. When there are many productive entrepreneurs and few rent-seekers, there are many targets to prey on, and few predators to compete with. From the point of view of an individual rent-seeker, this implies increased income possibilities. Figure 2 shows the payoff from rent-seeking, which is increasing in the share of entrepreneurs undertaking production (and decreasing in the share of entrepreneurs undertaking rent-seeing, termed 1-E, and measured from the right to the left).

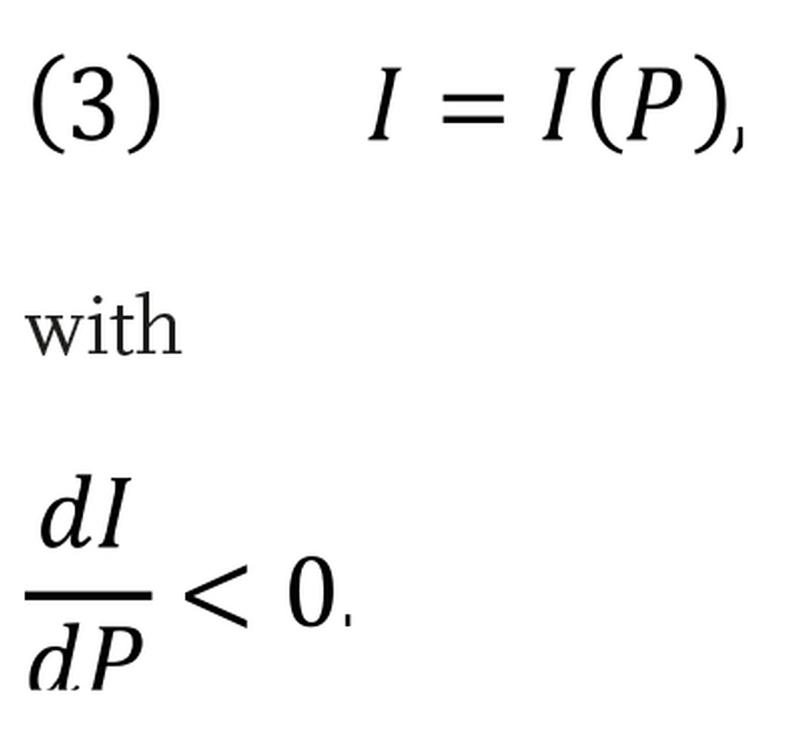

The income possibilities from rent-seeking are, in addition, affected by the possibilities for appropriating income from others than the private entrepreneurs. In particular, if there exists financial funds in the public sector, such funds may invite political rent-seeking, making it economically more tempting to enter into politics. Also, strong institutions prevent the possibilities for various forms of rent-seeking, and thus, other things equal, strong institutions decrease the income from undertaking rent-seeking.

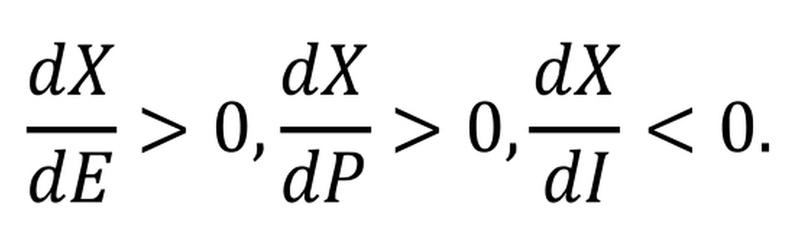

We term the individual income from undertaking rent-seeking by X, the availability of lootable public funds by P. The above may then be summarized in the following equation:

with

4.1 The equilibrium in the future

We assume that an equilibrium is defined in the conventional way, where we have an equilibrium if no agent, after observing what all other agents do, would want to change his chosen occupation. Thus, our equilibrium concept is subgame perfect equilibrium, and, following the standard procedure, we apply backwards induction. [1]

We make the following assumptions on the payoff functions:

The first part of Assumption 1A states that if no entrepreneurs are engaged in production, and all entrepreneurs are engaged in rent-seeking, then the individual payoff in production is higher than in rent-seeking. If this was not the case, there would exist a stable equilibrium where no entrepreneurs chose to undertake production. The second part of Assumption 1A states that if all entrepreneurs are engaged in production and no are entrepreneurs engaged in rent-seeking, then the individual payoff of a rent-seeker would exceed that of a producer. If this was not the case then there would exist a stable equilibrium where all entrepreneurs chose productive activities, and no entrepreneurs chose rent-seeking. Assumption 1A, thus, allows us to restrict attention to situations that are not corner solutions of the model. It is important to note that such corner solutions are perfectly possible. For instance, a corner solution where there is no producers may result if the institutional quality is sufficiently poor. Likewise a corner solution where there is no rent-seekers may result if the institutional quality is sufficiently strong.

Assumption 1B ensures that the equilibrium of the model is unique. The existence of equilibrium is ensured by Assumption 1A, but with the additional Assumption 1B there can never be more than one value of E where the payoff from production equals the payoff from rent-seeking. Thus, due to Assumption 1A, an equilibrium always exist, and due to Assumption 1B the equilibrium is unique. Also, due to conventional stability arguments, this equilibrium is stable.

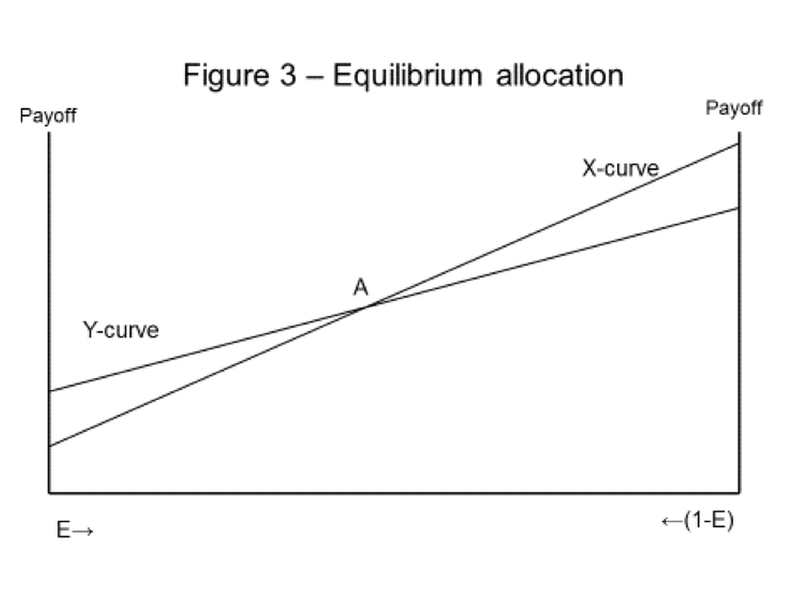

Figure 3 shows the two payoff functions, and the intersection of these payoff functions determines the future equilibrium allocation of entrepreneurs between production and rent-seeking, denoted by point A in the figure, as well as their future income level.

Figure 3: Equilibrium allocation

[1]. In game theory, a subgame perfect equilibrium (or subgame perfect Nash equilibrium) is an equilibrium such that the players’ strategies constitute a Nash equilibrium in every subgame of the original game. A common method for determining subgame perfect equilibria in the case of a finite game is backward induction. This is an iterative process for solving finite extensive form or sequential games. First, one determines the optimal strategy of the player who makes the last move of the game. Then, the optimal action of the next-to-last moving player is determined taking the last player’s action as given. The process continues in this way backwards in time until all players’ actions have been determined.

4.2 Current policy decisions and the future equilibrium

Consider now how the policy decisions in the present affect the future equilibrium. We assume that the country under consideration receives income from the sale of petroleum, and faces the decision about how to invest the proceeds from the petroleum sector. We assume that the size of the resource income is given by W.

Consider first the decision to use the resource income to establish a petroleum fund – i.e. dF = dW. We note from Equation (1) that this does not affect the payoff function of producers, while from Equation (2) we note that this shifts the payoff from rent-seeking up. The size of the vertical shift of the curve is given by

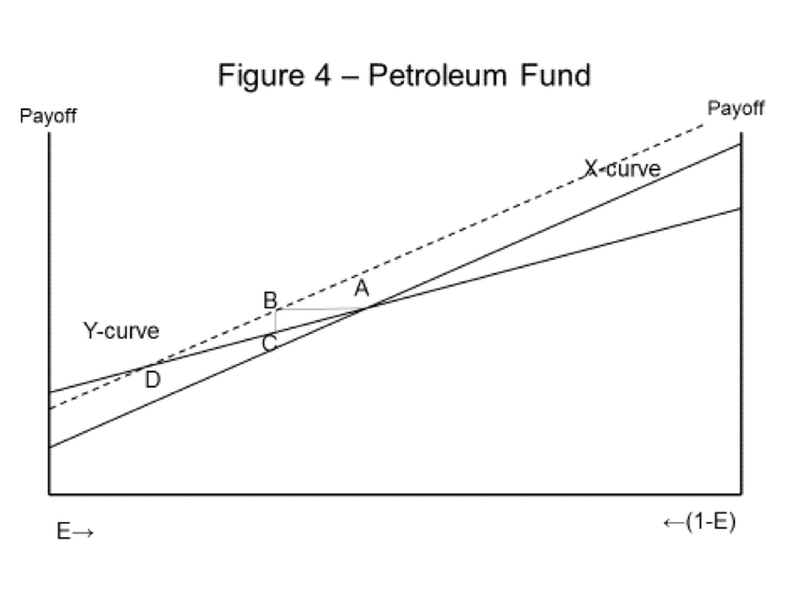

The effect of this policy decision on the future equilibrium is shown in Figure 4, with the new payoff function from rent-seeking represented by the dotted curve. We note that, paradoxically, the increased income opportunities generated by the presence of a petroleum fund push future income down.

The intuition behind this result is that when the individual payoff is shifted in favour of rent-seeking, then more entrepreneurs choose to rent-seek and less entrepreneurs choose to undertake regular production. The remaining intuition that needs to be described is why such a shift push aggregate income down, i.e. why the increased income opportunities result in reduced income. To understand this, assume that a sufficient number of entrepreneurs shifted out of rent-seeing and into production for the income of rent-seeing to fall to the initial level of income from production. This is represented in the figure by the movement from point A to point B. At point B, however, the income in production is lower than initially, namely by point C. The reason for this is that in point B and C there are less entrepreneurs and more rent-seekers. Thus, there are still incentives to move out of production and into rent-seeking, seen by the fact that point B which represents the income of rent-seekers is higher than point C which represents the income of producers. To equalise the future income in the two activities with the petroleum fund in place, we have to move to D, which is not only lower than point A and B, but also lower than point C.

Therefore, the potential challenge to the future equilibrium is that a petroleum fund may invite rent-seeking; it represents a future income that is lootable. The cost of this rent-seeking exceeds the wealth in the petroleum fund, as the rent-seeking has costs for the society in addition to the funds that are being appropriated by rent-seekers. The economic equilibrium shifts in favour of rent-seekers and in disfavour of producers, and this shift, in turn, sets in motion further downward spirals in the economy: the decline in the number ofproducers diminish their positive externalities on the rest of the economy, while the increase in the number of rent-seekers increase their negative externalities on the rest of the economy. Thus, more income opportunities, in equilibrium, actually produce less aggregate income.

Consider next an alternative policy option. Instead of investing the proceeds from natural resources in a fund, the incomes from natural resources are now invested in infrastructure, health and/or education. In the model we represent this by dG=dW. We note that in this case the curve for rent-seekers does not shift, but that the curve for producers shifts up with the size of the vertical shift of the curve given by

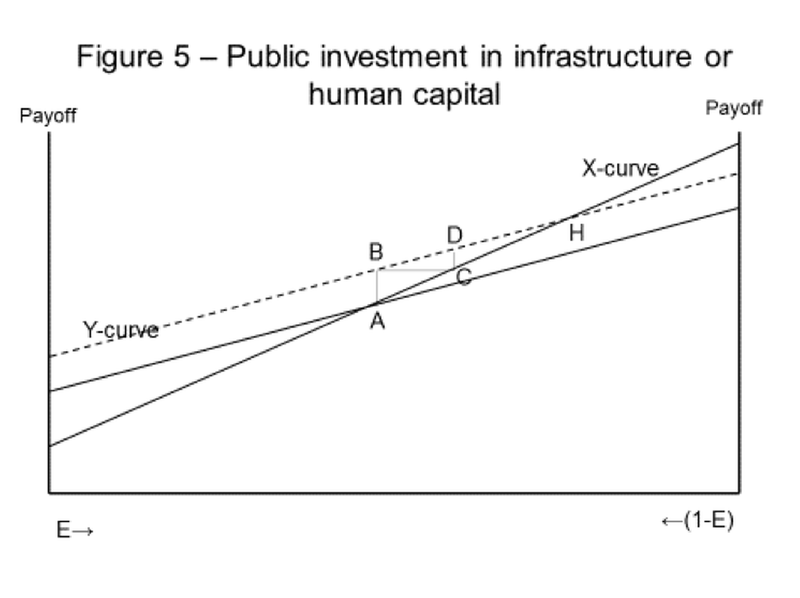

The effect of this policy decision on the future equilibrium is shown in Figure 5, with the new payoff function from production represented by the dotted curve. We note that, in contrast to the case with a petroleum fund, the future equilibrium involves higher income. Moreover, the increase in income is higher than the increased income opportunities for the entrepreneurs in production. The effect on the future equilibrium from this policy is therefore radically different from that of a petroleum fund.

Public investment in infrastructure or human capital

The reason for this result is that this policy decision increases the positive externalities created by entrepreneurs, and decreases the negative externalities created by rent-seekers. To see the intuition, consider again Figure 5. When the income opportunities of entrepreneurs increases, then for a given allocation of entrepreneurs between production and rent-seeking, the income of the entrepreneurs in production increases from point A to point B. But since the income of rent-seekers (again for a given allocation of entrepreneurs) is given by point A, it is more attractive to be a producer than a rent-seeker. Entrepreneurs therefore shift from rent-seeking and into production. To see why this process ends in a future income level that exceeds the income level created by the increased income opportunities for existing entrepreneurs, consider a situation where entrepreneurs move out of rent-seeking and into production until the income in rent-seeking is the same as in point B. This allocation of entrepreneurs is given by point C. At the allocation of entrepreneurs represented by point C, however, the income of entrepreneurs in production is given by point D, which exceeds the income in point C. Consequently, even more entrepreneurs move into production and out of rent-seeking. To re-establish equality between the entrepreneurs undertaking production and rent-seeking we have to move to point H.

Investments in infrastructure, health and/or education have some properties that may make them attractive from the point of view of society. First, such investments are favourable to entrepreneurs undertaking production, because the availability of a better infrastructure and/or a better workforce increases the profitability of production. This makes production more attractive, which is a benefit to society at large. Second, such investments are harder to expropriate than financial investments. This means that the government crowds in private entrepreneurs in production, and crowds out rent-seekers. Third, because of this combination, the government’s policy decision in the present has the effect of magnifying the future positive externalities from production, and dampening the future negative externalities from rent-seeking.

In sum, although the model is highly stylized and simplified, it suggests that when initial institutions are weak, then investing in assets that are not easily expropriated may induce incentives for future allocation of scarce entrepreneurial resources that are better that investing in assets that may be expropriated. The latter type of assets invite types of activities that have negative externalities for the rest of the economy, while the first type may invite activities that creates positive externalities.

In the model above, we have only seen the equilibrium consequences for the income of entrepreneurs of these two policy options. The difference in aggregate income, however, may be even higher, as entrepreneurs in production are likely to create better income opportunities and increased demand for workers, while entrepreneurs in rent-seeking, if anything, pull workers out of productive activities and into unproductive, or even destructive, activities.

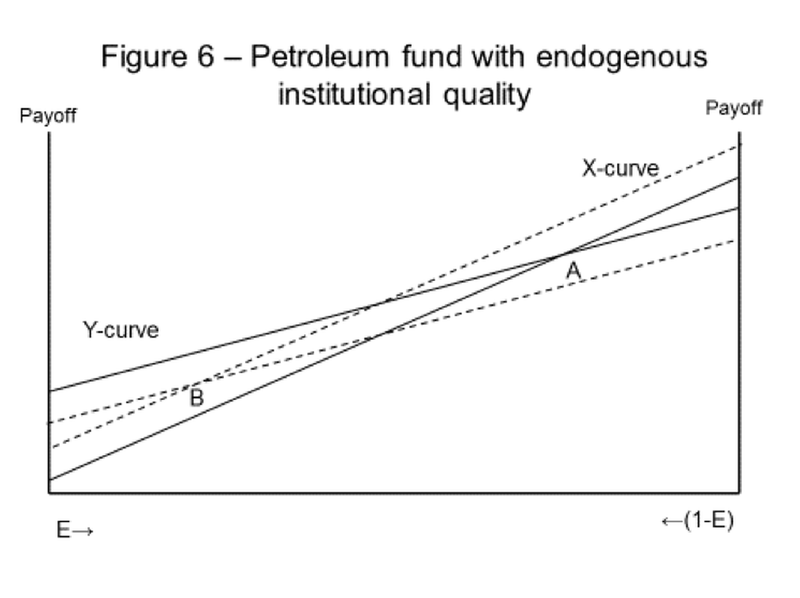

4.3 Endogenous institutional quality

So far we have considered the future institutional quality as given, and independent of the policy decision made in the present. We now extend the model by making the future quality of institutions endogenous.

Consider first the situation where a petroleum fund has been established. For those with political power this represents a possibility to appropriate resources. However, to be able to do so the institutions must be sufficiently weak for such appropriation to be possible. In turn, this creates an incentive to erode institutions. In the future, therefore, there is a danger that institutional quality may be worse if a petroleum fund has been established than if it has not. To be able to appropriate resources from the fund, institutions must, for the same reason as in Ross (2001a), be weakened. Formally, we can we can represent this with an equation for the quality of future institutions being dependent on the financial funds in the petroleum fund:

Inserting this into Equations (1) and (2) these now reads

We first note that the payoff function for producers is no longer independent of the establishment of a petroleum fund. When a petroleum fund erodes institutional quality, then the future payoff of producers decreases with the establishment of such a fund. Second, we note that the payoff of rent-seekers now increases not only because of the establishment of the fund itself, but also because such a fund depresses institutional quality, making future rent-seeking activity more profitable.

In Figure 6 this is represented by a downward shift in the payoff of producers, and an upward shift in the payoff of rent-seekers. We note that the future equilibrium shifts from point A to point B, with the new equilibrium involving less producers, more rent-seekers, and lower total income. Moreover, note that the fall in income is higher than the initial fall in income of producers. The reason is that the fall in the payoff of producers strengthens the incentive to move out of production, which in turn strengthen the incentive to move out of production even more. We have an institutional multiplier effect, which, unfortunately, pushes production further down exactly because production is pushed down in the first place.

Consider next a situation where the resource income is used to provide public goods that increases human or infrastructural capital. This may also affect the quality of institutions in the future, and several mechanisms may be at play. As regards the investment in human capital, such investments may increase the quality of institutions directly. There is also an important difference with financial investments, namely that human capital is more difficult to expropriate than financial capital. Therefore, the incentives to erode future institutions to appropriate resources that is present with financial investments are likely to be weaker, or even to be reversed, with investments in human capital. Human capital investments to a broad cross section of society empower citizens, and may increase their demand for inclusive institutions. With regard to infrastructural capital, the income generated in the private sector by this is also harder to expropriate than what is the case for financial capital. This can of course also partly be done by taxation – but only if there is something to tax. In fact, increased private incomes may be an incentive to build state capacity for taxation, which may have a beneficial effect on institutional quality.

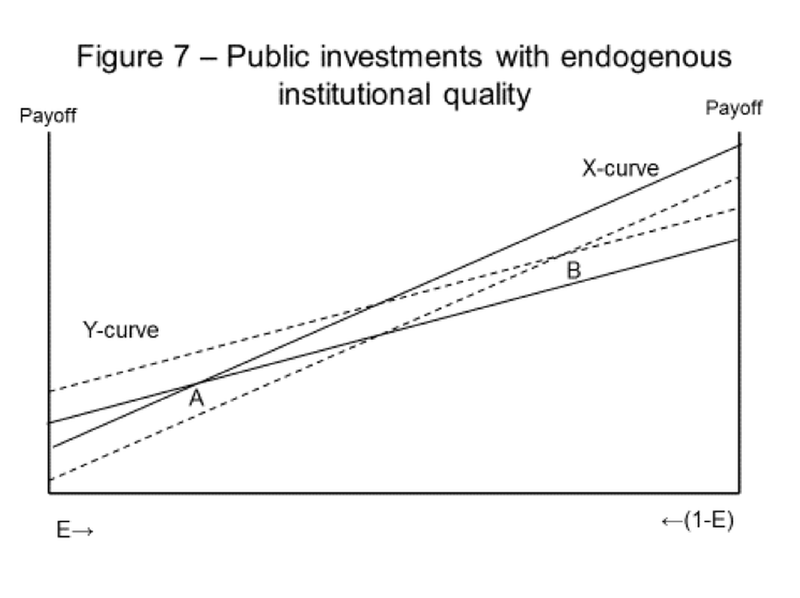

To capture such ideas we now assume that the future institutional quality is increasing in the public investments, i.e. we allow for

Inserting this into Equations (1) and (2), these now reads

In Figure 7 we show the effect of using resource income for public investments. If public investments improve institutional quality, then the payoff function of producers shifts up, while the payoff function of rent-seekers shifts down. As illustrated, the future equilibrium shifts from point A to point B, with increased income and production, and a reduced number of rent-seekers, as a result. We note that this time too we have a multiplier effect, in that the increase in the payoff from production attracts even more producers into production, increasing the payoff from production even more. The important difference is that this time the multiplier is positive. For this reason, the increase in future income exceeds the direct effect of the increased public investments.

4.4 Private investments

Until this point, the future income has been determined by the future allocation of entrepreneurs between production and rent-seeking. In addition to this allocation of entrepreneurs, however, the future equilibrium is also likely to be dependent on the level of private investments today. Increased investments in the present adds to the future capital stock, and therefore increasing future production and income.

Consider again the establishment of a petroleum fund. If this fund erodes institutional quality, decreases future production, and increases future rent-seeking, then the incentives for private investments may decrease. The drop in future income analysed above may be magnified by the private investment response. Consider next the use of resource income for public investments. If this increases future production, improves institutional quality, and decreases future rent-seeking, then the incentives for private investments in the present is improved. In this case, the future increase in private incomes is magnified.

Note the contrast between this conclusion and mainstream macroeconomic mechanisms. In the latter, a typical result is the crowding out of private investments by expansionary macroeconomic policy, as this increases interest rates or produces expectations of future increases in taxes. In the present model, by contrast, increased provision of public goods crowds in private investments. This result is similar to the possibility analysed by Barro (1990), although the mechanism here is different, working through aggregate increased returns in private production, reduced rent-seeking, and improved institutions.

5. Concluding remarks

An increasing number of petroleum exporting countries have established sovereign wealth funds. Some initial lessons from these funds can now be drawn. In some countries, such as Alaska and Norway, the establishment of petroleum funds seems to have been favourable. In others, such as Alberta, the design of the fund proved not to be robust to fulfil the intentions with the fund. Thus, even when the initial institutions are strong, a petroleum fund may not work to the advantage of economic development. The main differences between Alaska and Norway on the one hand, and Alberta on the other, seems to be found in the details of the design of the petroleum fund, and in particular its independence from political decisions.

In countries where the initial institutions are weaker, such as in Chad and Angola, experience shows that the challenges of establishing a petroleum fund are not isolated to the design of the fund itself. Main challenges also arise when taking into account the interaction of a weak institutional and democratic infrastructure on the one hand, with the availability of funds that may be easily expropriated on the other. This may produce political incentives which are damaging not only for economic activity, but also for the future quality of institutions, as well as for the incentives to invest in the private sector. By investing in education, health and infrastructure on the other hand, such incentives may be weakened or even reversed. At the same time, the need for such human or infrastructural capital investments are higher simply because their level is lower in the first place.

With reference to Tanzania, these arguments may suggest that the combination of a strong need for investments in human capital and domestic infrastructure, and the possible adverse effects on institutional quality, calls for not establishing a petroleum fund, but instead using incomes from natural gas domestically. This does not imply that such a policy will cure the potential problems arising from selling non-renewable resources. As experienced in many countries, there is still the problem that the investments from resource incomes are producing “white elephants” rather than investments that benefit the society at large (Robinson and Torvik, 2005). Further, as also experienced in East Africa policy decisions which implies increased use of funds to health and/or education may have a limited effect on the actual policy outcomes in these areas (e.g. Reinikka and Svensson, 2004).

Photo: Joachim Huber, Creative Commons / flickr

References

Acemoglu, Daron, and James A. Robinson. (2012) Why nations fail: the origins of power, prosperity, and poverty. New York: Crown.

Arezki, Rabah, Thorvaldur Gylfason, and Amadou Sy. (2011) Beyond the curse: policies to harness the power of natural resources. Washington D.C.: International Monetary Fund.

Barro, Robert. (1990) “Government spending in a simple model of economic growth”, Journal of Political Economy 98, S103–S125.

Cappelen, Alexander, Odd-Helge Fjeldstad, Cornel Jahari, Donald Mmari, Ingrid Hoem Sjursen, and Bertil Tungodden. (2016) “Not so great expectations: Gas revenue, corruption and willingness to pay tax in Tanzania”, CMI Brief 4: 2016. Bergen: Chr. Michelsen Institute.

Collier, Paul, and Anke Hoeffler. (1998) “On economic causes of civil war”, Oxford Economic Papers 50, 563–573.

Gelb, Alan. (1988) Oil windfalls: blessing or curse? New York: Oxford University Press.

Karl, Terry Lynn. (1997) The paradox of plenty: oil booms and petro states. Berkeley: Berkeley University Press.

Mehlum, Halvor, Karl Moene, and Ragnar Torvik. (2006) “Institutions and the resource curse”, Economic Journal 116, 1–20.

Reinikka, Ritva, and Jakob Svensson. (2004) “Local capture: evidence from a central government transfer program in Uganda”, Quarterly Journal of Economics 119, 679–706.

Robinson, James A., and Ragnar Torvik. (2005) “White elephants”, Journal of Public Economics 89, 197–210.

Robinson, James A., and Ragnar Torvik. (2013) “Conditional comparative statics”, in Daron Acemoglu, Manuel Arellano and Eddie Dekel: Advances in Economics and Econometrics. New York: Cambridge University Press.

Robinson, James A., Ragnar Torvik, and Thierry Verdier. (2006) “Political foundations of the resource curse”, Journal of Development Economics 79, 447–468.

Ross, Michael L. (2001a) Timber booms and institutional breakdown in Southeast Asia. New York: Cambridge University Press.

Ross, Michael L. (2001b) “Does oil hinder democracy?”, World Politics 53, 325–361.

Sachs, Jeffrey D., and Andrew M. Warner. (1995) “Natural resource abundance and economic growth”, NBER Working Paper No. 5398.

Torvik, Ragnar. (2011) “The political economy of reform in resource rich countries”, Chapter 13 in Arezki, Gylfason and Sy, eds., (2011).

van der Ploeg, Frederick. (2011) “Natural resources: curse of blessing?”, Journal of Economic Literature 49, 366–420.

This Working Paper is an output from Tanzania as a future petrostate: Prospects and challenges, a five-year (2014-19) institutional collaborative programme for research, capacity building, and policy dialogue. It is jointly implemented by REPOA and CMI, in collaboration with the National Bureau of Statistics. The programme is funded by the Norwegian Embassy, Dar es Salaam.