Tax and Public Finance

Improved taxation is a key for developing countries to escape from aid or singular natural resource dependency.

Current projects

Completed projects

Strengthening Fragile States through Taxation (FRAGTAX)

Public services, security and the legacy of pre-colonial states in Uganda

Tax Compliance, VAT Revenues and Business Development in Tanzania (TaCoTa)

Norad Governance and Transparency Section: Theory of Change

TaxCapDev-network

Tanzania as a Future Petro-State: Prospects and Challenges

Mapping Tax Compliance Cost for Businesses in Africa

Taxation in fragile states

Experiences with Electronic Fiscal Devices (EFDs) in Tanzania

Tax evasion: a review of the literature

Taxing the urban boom in Tanzania: Interests, incentives and real estate in Dar

Electronic Sales Register Machines, Tax Enforcement and Tax outcomes

Revenue mobilization at sub-national levels in Sudan

International Centre for Tax and Development (ICTD)

The political-economy of property tax collection in Tanzania

Peoples' views of taxation in Africa

Local government taxation and tax administration in Africa

The tax systems in Mozambique, Tanzania and Zambia: capacity and constraints

The Construction Transparency Initiative (CoST)

Linking procurement and political economy

The Basics of Integrity in Procurement. A Guidebook

Capital flight and the banking sector

Participation, representation and taxation in local governance in Angola

From curse to development: Natural resources, institutions and public revenues

The Political Economy of Natural Resource Management - Ghana and Nigeria

Building welfare

Improved taxation is a key for developing countries to escape from aid or singular natural resource dependency.

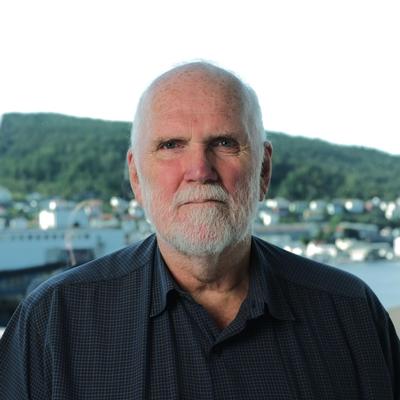

We study how governments in poor countries can raise financial resources in ways that enhance their effectiveness and political legitimacy. Through high quality, practically-oriented political economy research and communication activities, our research has informed reform agendas and policy debates on tax reforms in developing countries for decades.

We provide both empirical and theoretical insights and policy recommendations to governments, development agencies, private enterprises and civil society.

Our research and evaluation expertise:

- Tax compliance

- Taxation and governance

- Tax reform in natural resource rich countries

- Sub-national and informal sector taxation

- Intra-governmental fiscal relations

- International taxation and capital flows

- Tax and SDGs

Read the Tax Group's Annual Report 2023 here

Read about CMI's Research and Advisory Work on "Taxation and Public Finance Management in Tanzania 1993-2023" here