Property Taxation in Developing Countries

Revenue Contribution of Property Tax

The ‘Good’ Tax Turning into a ‘Bad’ Tax

Reasons for the Poor Revenue Contribution of Property Tax in Developing Countries

How to cite this publication:

Merima Ali, Odd-Helge Fjeldstad, Lucas Katera (2017). Property Taxation in Developing Countries. Bergen: Chr. Michelsen Institute (CMI Brief 1)

Property tax (PT) raises on average revenues of less than 1% of GDP in developing countries. In many African countries it contributes far less than 0.5%. Following such low contribution, there is a growing eagerness among policy makers to increase its share in GDP. This policy brief provides a theoretical rationale behind such enthusiasm by discussing the reasons for considering PT as a ‘good’ tax compared to other forms of taxes such as income and consumption tax. It also elaborates on conditions under which PT may lead to inefficiencies and inequities. Various reasons for the overall poor revenue performance of PT in developing countries and possible policy implications are examined.

Revenue Contribution of Property Tax

Though it can have many forms, property tax (PT) is generally levied as an annual tax on the value of real property such as land and buildings. There are exceptions to this definition as capital invested on land in general, and non-residential activities like businesses in particular, could be mobile. While PT as a share of GDP can reach as high as 2% or more in high-income countries, it accounts for less than 1% in developing countries. Figure 1 shows the revenue distribution of PT as a percent of GDP for different countries for the year 2010 based on data from IMF. Western European countries, United States, Canada and Australia on average collect PT that is close to 2% of their GDP. Some upper middle-income countries such as Brazil and Argentina also have a share similar to most developed countries. Transition countries in Central and Eastern Europe and former Soviet Republics revenues from PT represents close to 1% of their GDP. For most low-income African countries where data is available, PT contributes to less than 0.1% of their GDP.

Property Tax as a ‘Good’ Tax

There are a number of theoretical and policy justifications for the need to promote PT among developing countries.

Efficient: PT is considered more efficient compared to other forms of taxes such as consumption and income tax because its imposition does not affect resource allocation by distorting the decision to supply and invest in the form of human and physical capital. Because it is a tax on wealth, rather than productive activities, it does not undermine productive incentives – and can also encourage more productive use of land and property. This advantage holds because of the ‘immobile’ nature of the tax base.

Equitable: PT is considered as a progressive tax because land and capital, in general, are owned by relatively wealthy individuals. As a result, the burden of the tax is likely to be borne by middle and high income earners.

Administrative innovation: PT requires the creation of systematic record keeping and organisation, and involves the collection of detailed data on land and properties, thus potentially spurring broader administrative improvements.

Ideal source of local government revenue: Because the tax base is geographically delimited and paid by local residents with limited mobility, PT is generally regarded as a stable and predictable revenue source for local authorities. Because properties are physically immovable, it is in principle relatively straightforward for governments to identify and tax properties, even where administrative capacity is limited.

Promotes transparency and accountability: PT is highly visible to taxpayers and, in principle, linked to improved local services. As a result, it holds unique potential to act as a foundation for bargaining between taxpayers and governments over revenue and public spending, hence, making policy makers and local officials more accountable.

The ‘Good’ Tax Turning into a ‘Bad’ Tax

There are some exceptions to the above-mentioned advantages of PT that might result in inefficiencies and inequities. These exceptions may arise from factors such as the type of the tax base, the method used to assess the revenue base, and differences in the overall enforcement of the tax across localities.

Using mobile properties as the tax base: Using mobile properties as the tax base may result in inefficiency by affecting resource allocation. The base for collecting PT usually includes land and buildings. The efficiency advantage of PT that emanates from the immobile nature of the tax base only applies to land and not usually to buildings, especially non-residential structures that are mobile. For example, applying PT on businesses that use relatively more property as an input in their production may be distortionary by affecting their decision on how, where and in what form to invest. Taxing buildings disproportionately higher than land may also discourage maintenance, especially if improvements on buildings are considered as an increase in the tax base. Furthermore, when new and well-constructed buildings are taxed more heavily than slums, it can slow down urbanisation or growth of cities by curtailing construction of new buildings.

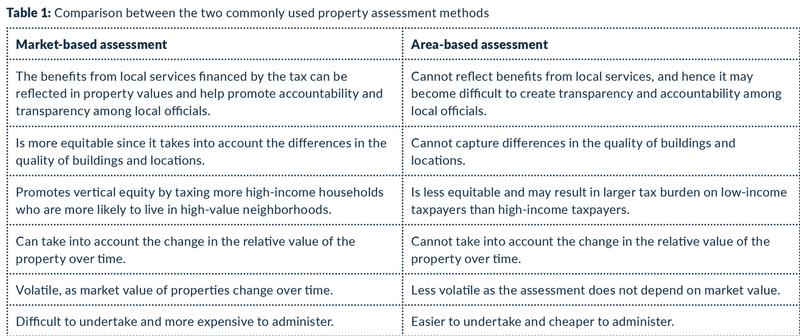

Using area-based assessment to assess the tax base: The equity argument with PT may or may not hold depending on how the tax base is assessed. Using market value to assess the tax base is generally considered fairer than using alternative approaches such as area-based assessment because the former reflects the benefits provided by local services financed by the tax. For example, the benefit from having a property closer to public gardens or major transport facilities offers more benefit to the owner that is not necessarily captured by a property’s dimension using area-based assessment. In general, valuation of properties that does not capture the real value of the property may result in differences in the effective tax rates across properties and hence becomes inequitable. Table 1 summarises the advantages and disadvantages of the two widely used valuation methods.

Significant variation in tax rates among localities: This may create inefficiency by affecting taxpayer’s location decision to move towards low tax localities. It may further lower the market value of properties in high-tax localities over time and result in loss of tax revenue.

Significant variation in enforcement and tax administration among localities: Even if tax rates do not vary much across localities to affect resource allocation, the mere variation in enforcement may do so. For example, taxpayers residing in localities with weak enforcement, in general, will face lower tax burden compared to localities with strong enforcement that can become inequitable. These variations may arise due to differences in capacity across localities or politics. For example, elected local officials may find it politically costly to aggressively enforce PT collection in localities where political elites or criminals live.

Not considering the income earning capacity of property owners: If PT fails to take into account the income earning capacity of property owners such as older people or those with unpredictable income sources, it may result in distortionary income re-distribution and erode the wealth of individuals over time. This is particularly a problem in developing countries where the capital market often is underdeveloped and other means of holding wealth such as stocks or other financial assets almost do not exist.

Reasons for the Poor Revenue Contribution of Property Tax in Developing Countries

One of the reasons for the poor revenue contribution of PT in developing countries is low-level of fiscal decentralisation. In principle, local government authorities are likely to collect PT more efficiently than central governments because they can more easily oversee local residents, have better information about their assets, and monitor their compliance. However, PT collection is often poor also in countries with a more decentralised system of revenue collection.

One of the most fundamental barriers to effective property taxation is the sustained resistance it faces from property-owning elites, who form a powerful lobby that can block both policy reform and effective implementation. This is a particular problem in large capital cities, where resources are concentrated and political and economic elites tend to be closely bound together. Indeed, in such cities, where bureaucratic capacity to overcome some of the administrative challenges is likely to be higher than elsewhere, elite resistance may form the primary obstacle. Other reasons for the poor revenue contribution of PT in developing countries are the generally poor PT administration, weak enforcement and taxpayers’ attitude.

Poor tax administration: This is largely due to inadequate human resource, infrastructure and limited information on properties. These challenges are reflected in a number of tax administrative tasks such as a narrow tax base, ineffective tax assessments of properties and very low tax rates (see Box 1).

Property tax administration in developing countries is generally characterised by the followings:

Narrow tax base: This is due to a large proportion of informally owned properties and a range of legal exemptions and preferential treatment to different types of properties or different groups of society.

Exemptions: These can be provided based on different factors such as the type of ownership and characteristics of the owner or occupier of the property such as exemptions to government-owned properties, properties used for charitable purposes, churches, schools, and hospitals. Such exemptions may create inefficiency if they affect economic competition among businesses and between businesses and the government. They may further narrow the tax base and create a disproportionate burden on taxpayers or localities that do not get such exemptions.

Ineffective assessment of properties: This may result in an underestimation of registered properties that further erodes the tax base. Of the two commonly used property assessment methods, market-based assessment is generally considered as a better tax base for efficiency and equity reasons (see Table 1). Despite this, area-based assessment is widely used in developing countries because it is relatively easier to undertake and cheaper to administer.

Low tax rates: Tax rates in developing countries are commonly very low. Yet, increasing the tax rate on properties is largely unpopular and may invoke negative reactions from citizens.

Flat rates: When the administrative capacity is low, area specific flat rates may be considered while the property tax system is being developed.

Taxpayers’ attitude: PT are often unpopular among taxpayers in developing countries due to a number of reasons. First, PT that is levied on the wealth of individuals or businesses may not necessarily correspond to the income of the taxpayers. This can particularly overburden those with limited incomes like pensioners. Second, PT on non-residential properties can be unpopular among business owners as it can affect their resource allocation and investment decisions. Third, collection of PT may not be matched with improved local services, largely due to corruption and low-level of accountability among local officials.

Weak enforcement: Low collection rate combined with weak enforcement is another problem in developing countries. Low political willingness of elected local officials to enforce taxes from the wealthy and the powerful can further exacerbate the low collection rates. Given the generally unpopular nature of PT among taxpayers, politicians may also be less willing to have strong PT enforcement on poor people residing in poorer neighborhoods in order to maximize their vote in elections. Furthermore, punishment for non-compliance such as confiscation of properties may not be politically feasible.

Policy Implications

Property tax is considered a cornerstone of current efforts to strengthen broad based direct taxation in many developing countries. Yet, it contributes to limited revenues in most developing countries. Given the above mentioned reasons for the poor revenue contribution of PT, the following factors may help increase its contribution over time:

- Revising the PT administrative structure from efficiency and equity perspectives such as the choice of the tax base, the tax rate and exemption policies.

- Improving the technical know-how to generate more accurate records on properties. This can be done for example through Geographic Information System (GIS) mapping to help increase the coverage and training of staff to upgrade valuation techniques. Regular updating of the property registers and valuation rolls is essential.

- Improving collection rate by promoting public awareness programmes to help increase compliance as well as by strengthening the enforcement measures.

- Strengthening fiscal decentralisation by giving more autonomy to local government to administer PT collection if the aim is to improve local service provision.

Recommended Literature

Bahl, R. (2009). Property Tax Reform in Developing and Transition Countries. USAID http://pdf.usaid.gov/pdf_docs/PNADW480.pdf

Bird, R. M. and Slack, E. (2002). Land and Property Taxation: A Review. World Bank. http://www1.worldbank.org/publicsector/decentralization/June2003Seminar/LandPropertyTaxation.pdf

Kelly, R. (2013). Making the Property Tax Work? International Center for Public Policy Working Paper 2013: 11. Andrew Young School of Policy Studies, Georgia State University. http://scholarworks.gsu.edu/cgi/viewcontent.cgi?article=1041&context=icepp

Monkam, N. and Moore, M. (2015). How Property Tax Would Benefit Africa. African Research Institute. http://www.africaresearchinstitute.org/newsite/publications/property-tax-benefit-africa/

Norregaard, J. (2013). Taxing Immovable Property: Revenue Potential and Implementation Challenges. IMF Working Paper WP/13/129. http://www.imf.org/external/pubs/ft/wp/2013/wp13129.pdf

Slack, E. (2011). Property Tax in Theory and Practice. IMFG Papers on Municipal Finance and Governance, No 2. http://munkschool.utoronto.ca/imfg/uploads/173/enidslack_imfg_no._2_online.pdf

Smoke, P. (2013). Why Theory and Practice are Different: The Gap between Principles and Reality in Sub-National Revenue Systems. International Center for Public Policy Working Paper 13–13. Andrew Young School of Policy Studies, Georgia State University. http://scholarworks.gsu.edu/cgi/viewcontent.cgi?article=1043&context=icepp

Project

This Brief is an output from the project Taxing the urban boom in Tanzania: Interests, incentives and real estate in Dar es Salaam and Mtwara. The project (2016–2017) is funded by the Norwegian Embassy in Dar es Salaam under the framework agreement between the Embassy and Chr. Michelsen Institute on ”Development analysis as basis for aid transformation, public debate and policy change”.

Odd-Helge Fjeldstad